Table of Contents

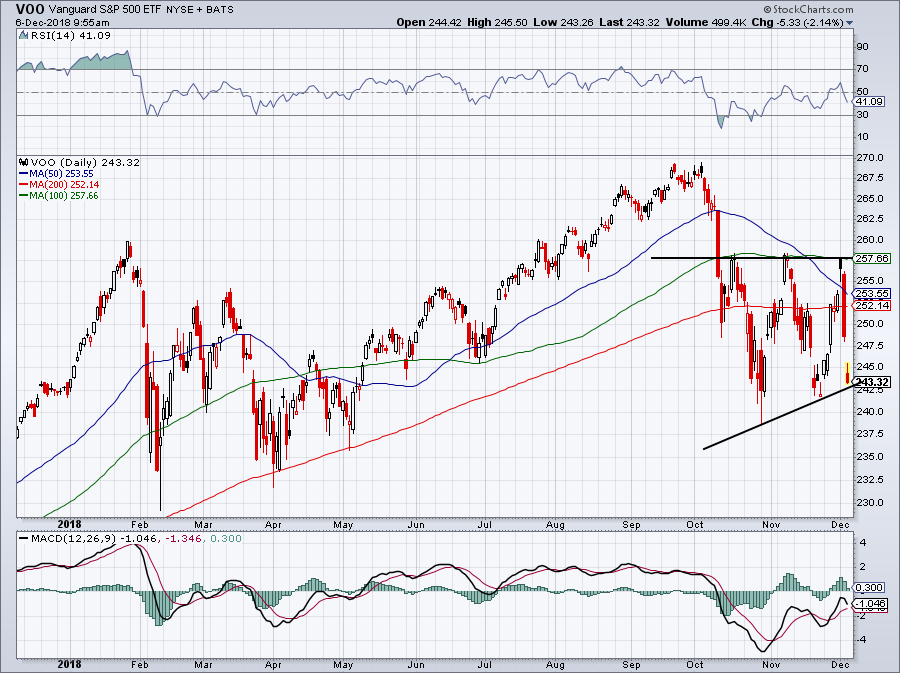

- VOO Stock Price Today (plus 21 insightful charts) • ETFvest

- VOO - Short Interest - Vanguard 500 Index Fund - Short Squeeze, Short ...

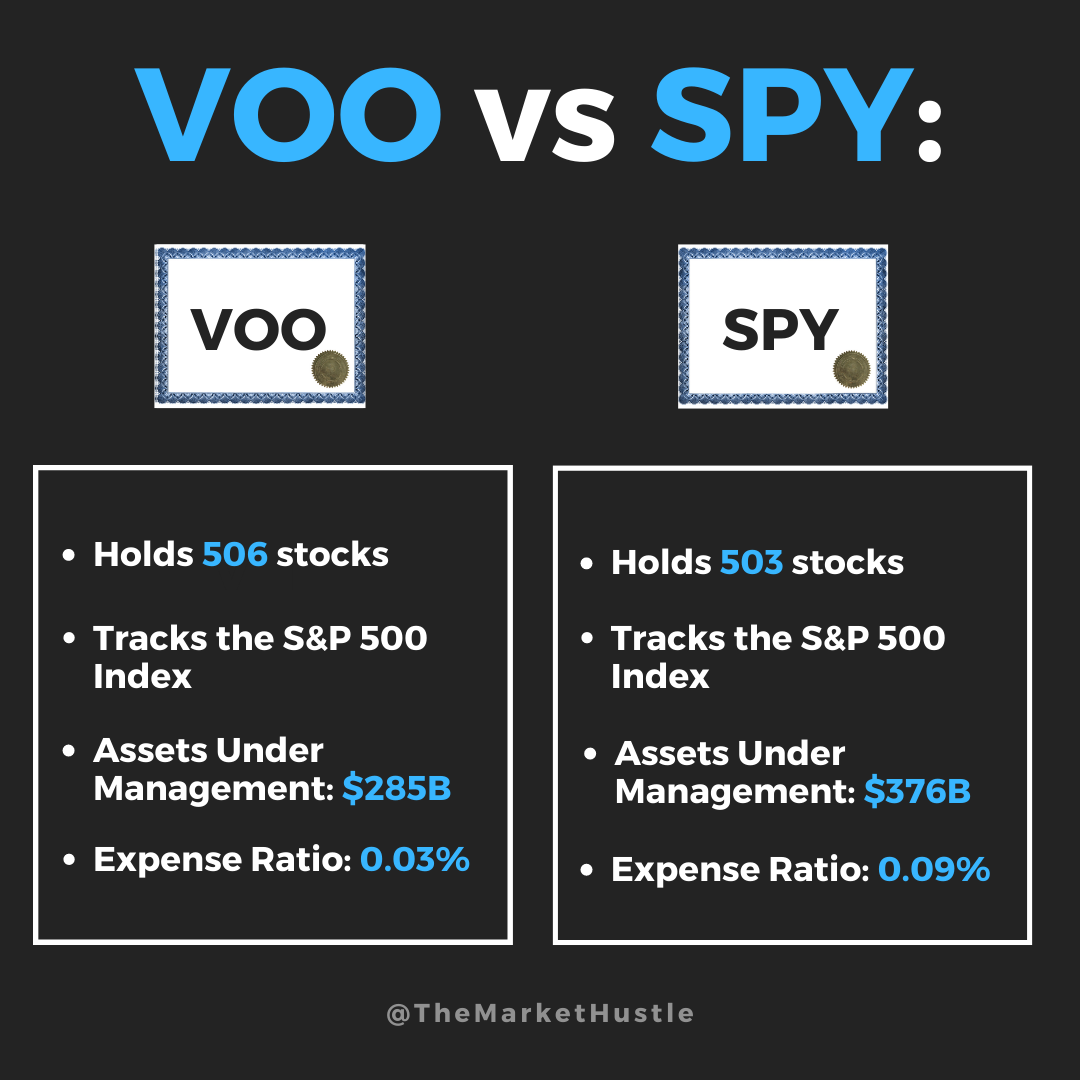

- VOO VS SPY - Which S&P 500 ETF Is Better? — The Market Hustle

- Here's Why You Should Buy Vanguard ETFs During the Market Meltdown ...

- Voo Stock, Vanguard S&P 500 Etf, Voo Stock Analysis, Voo News, Voo ...

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- Vanguard S&P 500 ETF Trade Ideas — AMEX:VOO — TradingView

- Voo Etf Price History at Helen Robledo blog

- VOO介紹:美股報酬最佳的ETF!慢慢變富的最好選擇,報酬以及風險分析 - 懶人經濟學

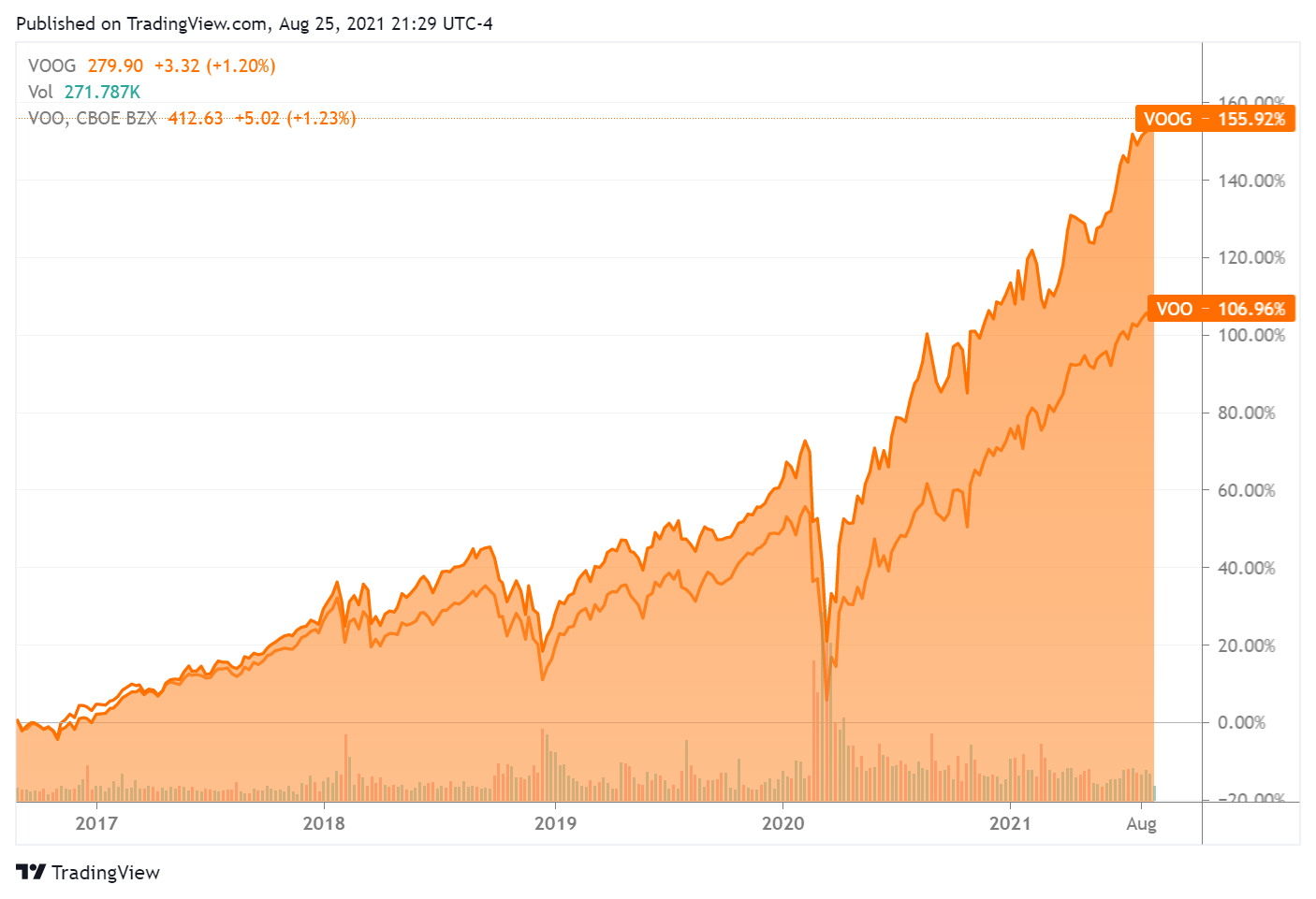

- VOOG: Vanguard의 S&P 500 성장 ETF는 계속해서 빛나고 있습니다 : 네이버 포스트

Current Price and Performance

Key Statistics and Holdings

News and Trends

Recent news and trends surrounding the Vanguard S&P 500 ETF (VOO) on Google Finance have been largely positive, with the ETF benefiting from a strong US economy and a bullish market sentiment. Some of the key news stories driving the ETF's performance include: The ongoing economic recovery from the COVID-19 pandemic The rise of the technology sector, led by companies such as Apple, Microsoft, and Amazon The growth of the healthcare sector, driven by advances in medical technology and an aging population The impact of monetary policy decisions by the Federal Reserve on the overall market The Vanguard S&P 500 ETF (VOO) is a popular and widely traded ETF that offers investors a diversified portfolio of the 500 largest publicly traded companies in the US. With its strong track record of performance, diverse portfolio, and low expense ratio, the VOO ETF is an attractive option for investors looking to gain exposure to the US stock market. By tracking the current price and news surrounding the VOO ETF on Google Finance, investors can stay up-to-date on the latest market trends and make informed investment decisions.For more information on the Vanguard S&P 500 ETF (VOO) and other investment opportunities, visit Google Finance today.

Note: The prices and statistics mentioned in this article are subject to change and may not reflect the current market situation. It's always recommended to consult with a financial advisor or conduct your own research before making any investment decisions. Word count: 500 Meta Description: Get the latest news and price updates on the Vanguard S&P 500 ETF (VOO) on Google Finance. Learn about its performance, key statistics, and what it means for investors. Keyword: Vanguard S&P 500 ETF (VOO), Google Finance, ETF, stock market, investment, S&P 500 index.